Turning Taxes into (Clean) Power:

How Corporations are Energizing America’s Grid

INSIGHT: Big corporations are unlocking a superpower—federal tax credits that make investing in renewable energy infrastructure a low-risk strategy to generate financial and environmental returns.

The expansion of renewable energy tax credits under the 2022 Inflation Reduction Act has profoundly reshaped the U.S. clean energy landscape. What was once considered a niche tax strategy has now gone mainstream, driving the development of solar, wind, and energy storage projects across the country.

Companies that owe federal taxes can transform those obligations into clean energy investments, fueling a surge in infrastructure, job creation, and economic growth. “We are seeing our corporate clients significantly increase their focus on tax equity as a way to meet financial and sustainability goals,” said Devin Sanderson COO and Head of Energy at Churchill Stateside. “The Inflation Reduction Act has shifted these conversations from theoretical to practical, with businesses actively leveraging tax credits to build clean energy projects that drive measurable results."

This legislation has sparked remarkable momentum over the past two years, demonstrating how strategic tax policy can drive innovation and unlock both economic growth and sustainable advancements.

Corporate tax incentives stand out because they entrust the acceleration of the clean energy transition to those who drive real change: developers advancing clean energy projects, financial architects who craft pathways for funding, tech pioneers who scale new solutions, and data leaders who enhance transparency and insight. Notably, the legislation carves out opportunities for underrepresented innovators to step forward and shape this evolving industry.

Tax equity is a financial investment structure that allows companies with significant federal tax liabilities to invest in renewable energy projects in exchange for tax benefits. These benefits typically include federal tax credits and depreciation which help offset the investor's tax obligations, in addition to preferred cash flow. By providing upfront capital to developers, tax equity investors enable the construction of clean energy infrastructure like solar, wind, and energy storage projects, fostering sustainability while generating financial returns. It’s a critical tool for expanding renewable energy in the U.S. while aligning financial strategy with environmental impact.

Transferable tax credits, introduced under the IRA, differ from traditional tax equity structures in that they are not investments but rather credits that can be sold outright. They allow companies that can’t fully utilize their tax credits to transfer them to other entities with sufficient tax liability, simplifying participation in clean energy funding. Unlike tax equity investments, transfer credits involve less documentation and fewer complexities, making them an efficient tool for supporting renewable energy projects while broadening the pool of participants.

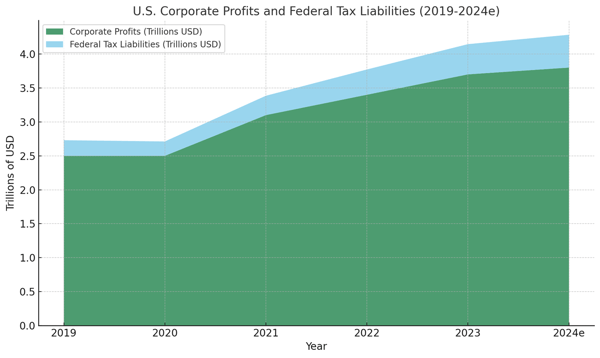

In the US, federal corporate profits have achieved all-time highs, increasing by about 52% from 2019 to 3Q2024. The surge in 2021 can be attributed to factors such as fiscal stimulus measures and a rebound in consumer demand. Corporate tax liabilities have mirrored that growth by ~2x, up almost 110% during this period.

Note: 2024 figures are estimates based on available data up to September 30, 2024

The financial returns from renewable energy tax credits, coupled with the chance to reduce operating costs and tax liabilities, have positioned renewable infrastructure projects as some of the most compelling corporate investments today. Add in the benefit of reduced risk, thanks to transferability and other provisions, and the opportunity becomes hard to ignore.

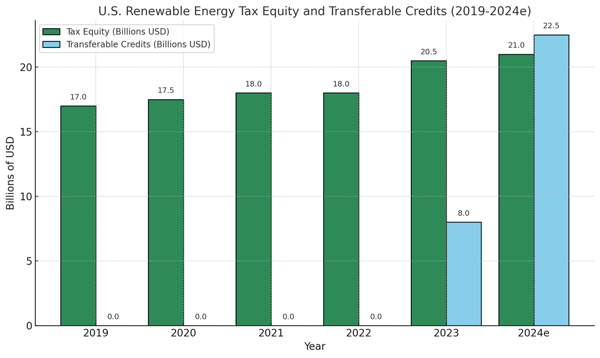

And the tax and sustainability teams of corporate America are paying attention: corporate investments in U.S. renewable energy tax equity have shown significant growth from 2019 through 2024. "Our corporate clients are increasing their annual allocations toward tax equity and focusing on impactful projects that align with their financial and sustainability goals," said Matt Hart, VP Investor Relations. "We’re seeing tax, sustainability, and procurement teams working together like never before to ensure tax equity projects deliver measurable benefits for their organizations and the environment."

Sources: Novogradic, Crux, S&P Global, Churchill Stateside Group

In 2023, the market for the transferability of certain renewable energy tax credits saw approximately $8 billion in tax credit sales, primarily driven by solar and storage projects according to Crux Climate. Looking ahead, the transferable tax credit market is expected to expand significantly. Reunion estimates that the total size of the clean energy tax credit market will surpass $45B in 2024, of which $21B to $24B will be transferred.

These trends indicate a robust and growing commitment from corporations to invest in renewable energy, leveraging tax equity and transferable credits to support clean energy projects across the United States.

Want to learn more about making renewable energy part of your corporate strategy? Let's connect!

About Churchill Stateside Renewables

At Churchill Stateside, we combine financial innovation with environmental impact. Our focus is on placing tax equity and transferable credits generated by renewable energy developers with our corporate clients to advance their environmental impact and provide financial returns. We have been actively structuring renewable energy tax equity products since 2006, placing tax equity for over $6.5 billion in renewable energy projects throughout the US.

Securities offered through Churchill Stateside Securities, LLC (“CSS”), member FINRA/SIPC registered with the MSRB. Non-securities products and services offered through Churchill Stateside Group, LLC (“CSG”). CSS and CSG are affiliated through common ownership and/or control. Certain individuals associated with or employed by CSG may also be registered representatives associated with CSS. Churchill Stateside Securities LLC does not offer tax or legal advice.

Learn How Churchill Stateside Securities Can Provide Solutions For You

At Churchill Stateside, we're driving clean energy innovation at the intersection of finance and sustainability. We empower major corporations, insurance firms, and global conglomerates to leverage renewable energy tax credits for environmental impact and material financial benefits.